Carbon Tax Explained

- Climate, Energy, Government, Sustainable Development

- carbon price, carbon tax, Featured

- April 1, 2016

With the international commitment in Paris calling for the decarbonization of the global economy by the second half of this century, the task we now face is transforming that commitment into reality.

There is no magic bullet that will deliver a decarbonized, net-zero emissions economy. What is required of us stretches across all aspects of human society, from economics and technology to our relationship with each other and with nature herself.

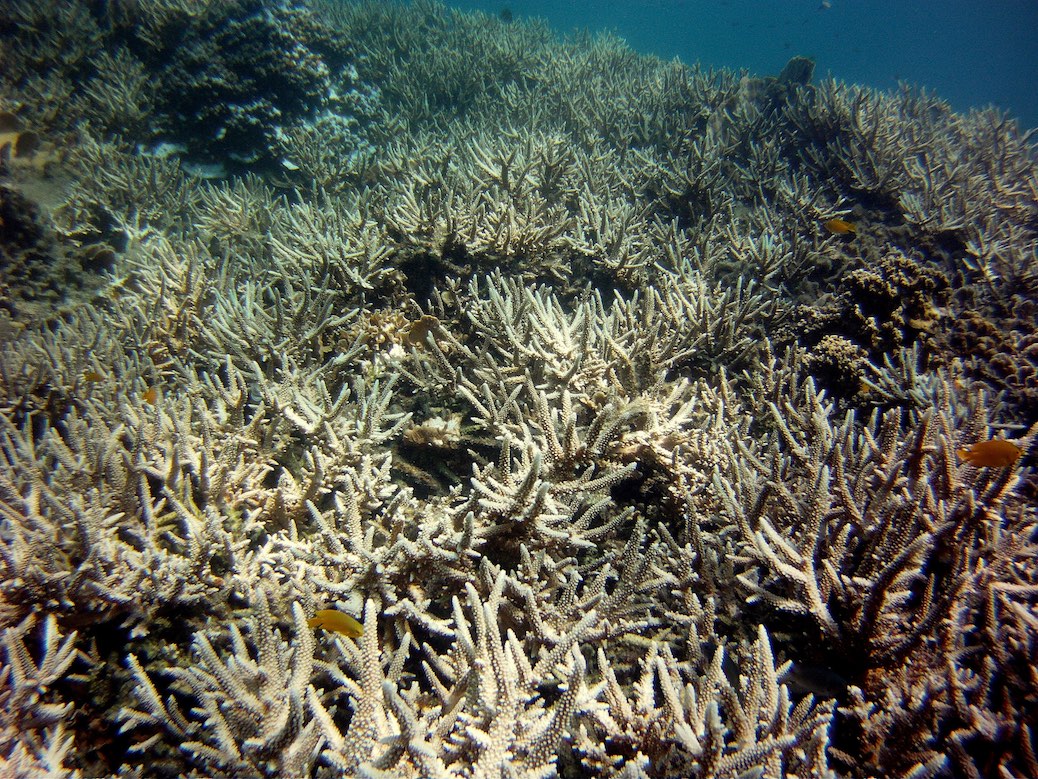

If there is a common thread that can set in motion action on all fronts, it is arguably putting a price on carbon. In a very real sense, we already pay the cost of carbon emissions, but those costs are spread throughout society as an economic externality manifesting as damaged crops through droughts and floods, increased health care cost from heat waves or risk to communities from extreme weather and rising sea level – to name but of few of the impacts of continued and increasing carbon emissions. Quantifying a price for carbon brings the cost back to those who are responsible at the source of emissions.

Pricing carbon is about more than just climate change, it is an important step toward economic health, social justice and environmental sustainability.

How do we put a price on carbon?

Throughout this series we will explore the various mechanisms, either proposed or already implemented in some parts of the world. One of these strategies is a carbon tax, as implemented in British Columbia, Ireland, Sweden, Chile, Australia and other nations around the world.

The reflexive opposition to environmental policy initiatives in our polarized political discourse (especially here in the U.S.) is misleading and doesn’t reflect the real potential benefits of pricing carbon through a carbon tax or other potential pricing strategies. An approach actually endorsed by many conservative thinkers, a carbon tax can bring with it not only emissions reductions but increased energy efficiency and a stronger economy.

This video produced by the Carbon Tax Center introduces how a carbon tax could work to effectively reduce carbon emissions, without destroying the economy, and other “myths” as we so often hear opponents to any form of carbon mitigation or pricing.

There are many avenues we can take on our journey toward a decarbonized economy. In subsequent posts we will explore in more depth strategies for carbon pricing and the advantages and disadvantages of each one.

This post first published in GlobalWarmingisReal.com

Featured image credit: Georgie Sharp, courtesy flickr